Celestia tia

Collective Shift Analysis

To see Collective Shift’s analysis, sign up for our membership!

Summary

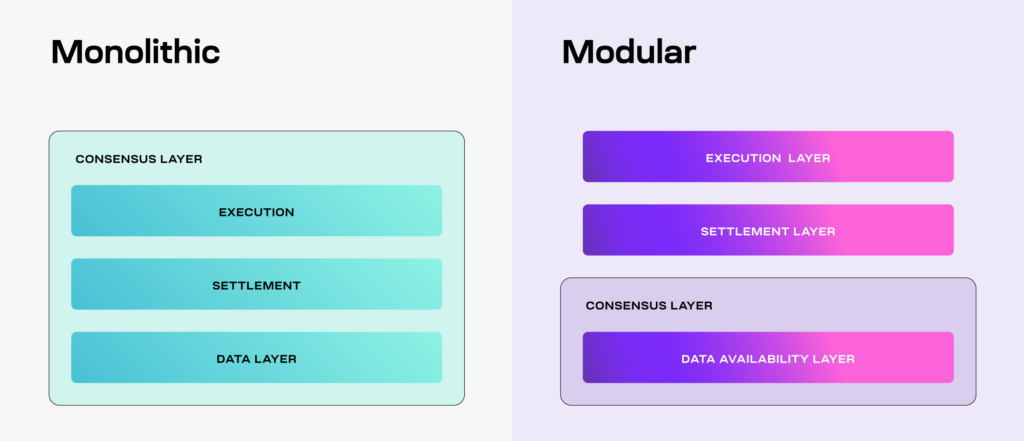

Celestia is a blockchain but designed differently. It takes a modular approach to build a scalable data availability layer to service data-hungry blockchains.

Rather than having one blockchain do everything (called ‘monolithic’), Celestia offers a different solution by splitting up core functions.

- Example ➡️ Solana performs all the roles it takes to be a blockchain. They deal with holding the data, settling the transactions and housing all the activity.

But in recent years, there has been a move for blockchains to separate these roles (called “modular”).

Instead of handling all the duties of a blockchain, such as Solana’s approach, it breaks it down and only handles a select few, outsourcing the rest.

- Example ➡️ Ethereum outsources most of its user activity to ‘L2s’ so users can have faster transactions and cheaper fees.

What Does It Provide?

Celestia provides data availability (DA) as a service to other blockchains or apps. You can also think of this data publishing.

Its job is to ensure the data is (or was) there and verify that data (i.e. the transaction details) have been published to the world.

All blockchains, especially newer networks such as Optimism, rely on posting and keeping large amounts of this data to ensure all transactions are valid.

How It Works

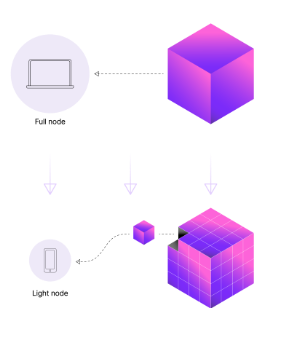

To do this job, Celestia uses something called ‘data availability sampling (DAS)’ to ensure data is available without doing a bunch of extra work. Simply, it takes a sample of some data to know the rest is valid and uses lower resource-demanding ‘light nodes’ to help scale and sample the network.

It’s like taking a small piece of pie and being able to reconstruct the pie’s size and the ingredients in it.

What Need Does Celestia Solve?

But why is data availability important?

This is a fair question, as it’s not obvious or a narrative that’s as easy to grasp as gaming or DeFi.

As blockchains grow, verifying and holding the data becomes more expensive.

Celestia ensures that anyone can inspect and verify a blockchain’s data.

The problem

New networks called ‘rollups’ (Optimism or Arbitrum One)—designed to add scalability to a blockchain—must house vast amounts of data.

To settle transactions to Ethereum, these rollups need to pay extremely high fees, and not all can afford it.

This is where Celestia comes in. It is a low-cost way to store the necessary data to operate securely.

Growing demand

Demand is growing fast for the service that Celestia offers—that is, the provision of cheap and accessible data-publishing guarantees.

The biggest potential users of Celestia’s data availability network are Ethereum L2s and rollups. These scaling solutions have exploded in usage, with a trend to outsource activity to these other layers. Making it an opportune time for Celestia to capitalise on this fast-growing and essential need for data-publishing guarantees.

Likewise, any blockchain looking to use a “modular” approach and outsource data availability are potential users.

Many may question whether an upcoming upgrade to Ethereum (i.e. EIP-4844) will create more space on Ethereum to store this data and thus undermine Celestia.

Not quite. This upgrade is only a one-time fixed increase.

In many ways, it’s like adding an extra lane to a congested highway. It may free up space immediately, but eventually, more drivers will use the road and congestion issues will resurface.

Many rollups will still be priced out as the cost is relatively high—it’s like adding an extra lane on a congested highway. It may free up space immediately, but eventually, more people use the road and the bottleneck returns.

Therefore, after EIP-4844, many rollups will likely still find it too expensive to store data on Ethereum. Should this happen, Celestia will be an alternative solution for these priced-out rollups and other services looking to store data.

Think of data availability as a sports game

A great analogy to drive home this problem is comparing it to watching a football game without a stream.

Essentially, you’ll be trusting the scores and stats are being recorded honestly, with no way to verify whether it was true or not, without being at the game directly.

This happens in blockchains today—data needs to be published somewhere so it can be checked if the transaction history is telling the truth. Without data publishing, you’re only getting the game’s final score without evidence.

TIA Token Utility

Celestia’s native token is TIA, the total supply of which is 1 billion.

Use cases for TIA are as follows:

- Paying for blobspace: To publish data to Celestia’s blobspace, rollups must pay the transaction fee with TIA.

- Securing the network: Because Celestia is a proof-of-stake blockchain, validators must stake a certain amount of TIA to participate in consensus. TIA holders can delegate their TIA to a Celestia validator for a portion of their validator’s staking rewards.

- Paying for gas on other rollups: Developers can choose to make TIA the gas token for their rollups. While this can simplify the construction of a rollup, it also introduces various challenges. (More on this in our member-only analysis below.)

- Contributing to governance: TIA holders and stakers can propose and vote on governance proposals to change a subset of network parameters (e.g. Celestia’s block size). They can also vote to spend TIA from the community pool, which receives 2% of all Celestia block rewards.

Also, as per Celestia’s FAQ page, a fee-burn mechanism similar to Ethereum’s EIP-1559 may eventually be introduced. (That is, a mechanism where a portion of the TIA used to pay for transactions will effectively be deleted, lowering the supply of TIA.)

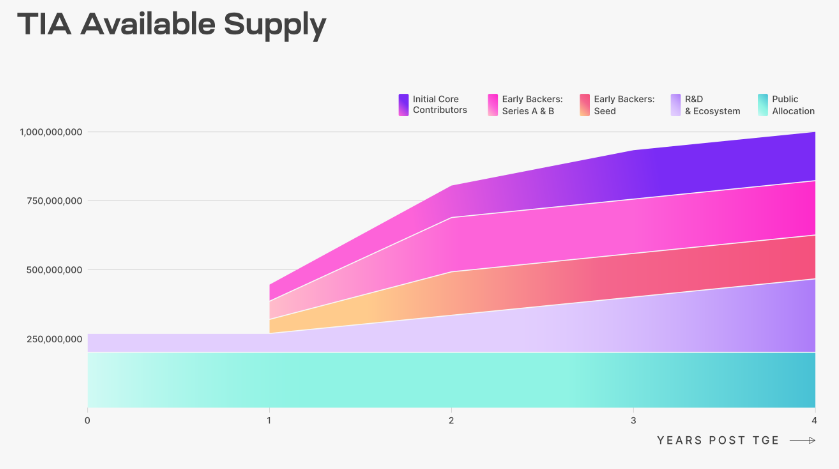

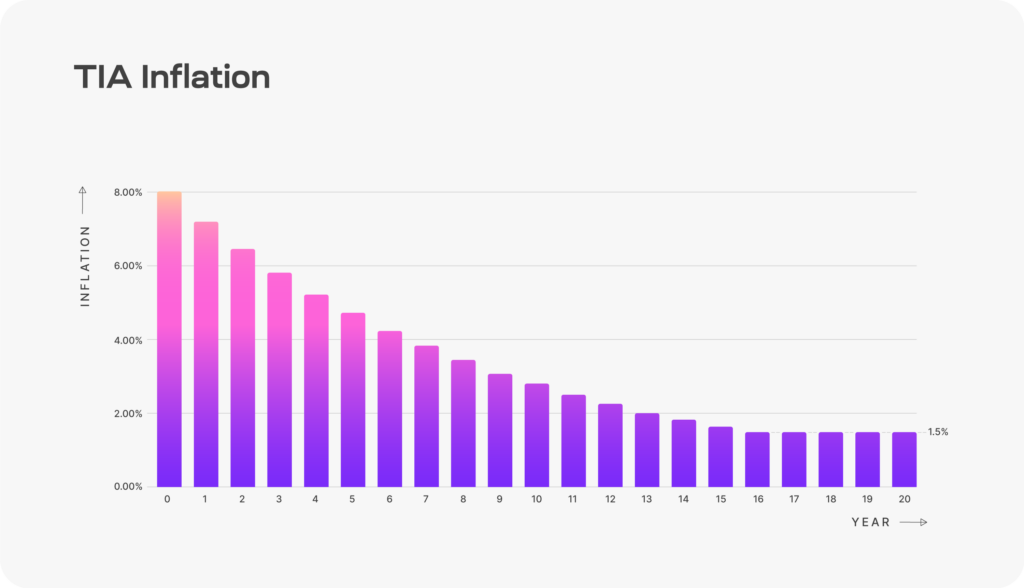

Inflation schedule

8% in the first year, decreasing 10% per year until reaching an annual inflation floor of 1.5%.

Allocation of TIA

Below is a table that shows the 5 categories to which TIA was allocated at launch and their respective unlock schedules.

| Category (initial % allocation) | Unlock schedule |

|---|---|

| Public: Genesis drop and incentivised testnet (7.4%) | Fully unlocked at launch. |

| Public: Future initiatives (12.6%) | Fully unlocked at launch. |

| R&D and ecosystem (26.8%) | 25% unlocked at launch, with the remaining 75% unlocking linearly from years 1–4. |

| Initial core contributors (17.6%) | 33% unlocked at year 1, with the remaining 67% unlocking linearly from years 1–3. |

| Seed investors (15.9%) | 33% unlocked at year 1, with the remaining 67% unlocking linearly from years 1–2. |

| Series A and B investors (17.6%) | 33% unlocked at year 1, with the remaining 67% unlocking linearly from years 1–2. |