With the halving roughly 40 days away, now is a great time to take stock of your game plan for this bull market. In this article, I share what I’m doing in the lead-up to the halving and what I expect in the weeks and months afterwards.

Key Takeaways

- Bitcoin’s next halving will happen in mid-April. In the weeks and months after this event, prices should continue climbing. Altcoins will eventually outperform as FOMO and greed take over.

- Between now and the halving, it’s impossible to tell what BTC will do. The limited historical data would suggest price consolidation is overdue.

- I’m not buying BTC because I’m already comfortably positioned. If I weren’t, I’d be aggressively averaging into a position now.

- Funding rates, RSI and memecoin performance are a few potential indicators of local tops.

- Bitcoin remains the best risk-adjusted play, in my opinion.

Contents

Bitcoin’s Pre-Halving Pump

BTC has historically pumped in the lead-up to Bitcoin’s halving. This time was no different. If history were to rhyme, we’d see some consolidation over the coming weeks before rallying higher in the months thereafter. However, since BTC has climbed so aggressively this time, is it still a good time to buy the orange coin?

To Chase or Not to Chase, That Is the Question

While investing in crypto is much less dramatic than Shakespeare’s Hamlet, the human emotions of fear and greed don’t make it any easier.

The truth is that you should have invested more aggressively in the prior weeks and months. However, you are also not late. The hardest part is knowing how to enter a position or increase your portfolio size after BTC’s impressive rally over the past six months.

Here’s the good news: prices have taken a breather near all-time highs in USD terms.

And here’s the bad news: dips in price continue to be bought up aggressively, as Checkmate covered yesterday.

In previous bull markets, 30% wipeouts were to be expected. So far in this bull market, the most we’ve seen is around 20%. For this latest short-lived pullback, the worst it got was around 15%.

For now, I’m not buying more BTC. I’m comfortable with how much I have as a percentage of my portfolio. However, if I were in a different position, I’d dollar-cost average (DCA) heavily now.

I’ve long advocated for being in the market because having some exposure generally reduces FOMO, which, in turn, reduces the chances of making poor investment decisions.

ETF Wave Followed by Tsunami

While it’s always dangerous to say “this time it’s different,” there’s no denying that this bull market will have key differences. (Of course, there will be many similarities, too.)

Institutional and retail money can now access BTC easily and from one lens, safely. Despite BlackRock’s spot bitcoin ETF being the fastest ETF ever to reach $10 billion, most funds have yet to enter this space.

The sales force of BlackRock and other ETF issuers have only just begun selling to clients, and most institutions are still behind relative to customer demand. When combined with ETF applications from places such as Hong Kong that are yet to be launched, you can see how a tsunami of funds could keep flowing into BTC and ETH.

Eventually, profit-takers will move further out of the risk curve, causing altcoins to go on a period of strong outperformance. Some altcoins have already been doing this.

This leads me to the point of how history will continue to rhyme. Fear and greed are the simplest predictors of any investment class. For this reason, the value of the entire crypto market will likely soar way beyond its fundamentals before a sharp correction. In this context, it will not be different to previous cycles.

Unsustainable Funding Rates

Funding rates had shot up to over 100% for not only BTC but a vast number of altcoins. It was unsustainable and dangerous for traders. Another way of looking at funding rates is that traders are willing to borrow at 100% interest rates to use leverage. It can be indicative of froth and that the market is nearing a temporary top.

RSI Was on Fire Before Latest Dump

The relative strength index (RSI) is a chart indicator that can support an investor’s decision-making process. Recently, the RSIs of various cryptocurrencies were signalling that the market was getting ahead of itself. (Like any indicator, the RSI should not be relied upon in isolation.)

On the four-hourly and daily timeframes, the RSI was printing above 80 for many cryptocurrencies before the recent sell-off, indicating overbought territory. As such, a patient investor should wait for the RSI to reset to 50–80 before jumping heavily into positions.

Meme-able Pump Power

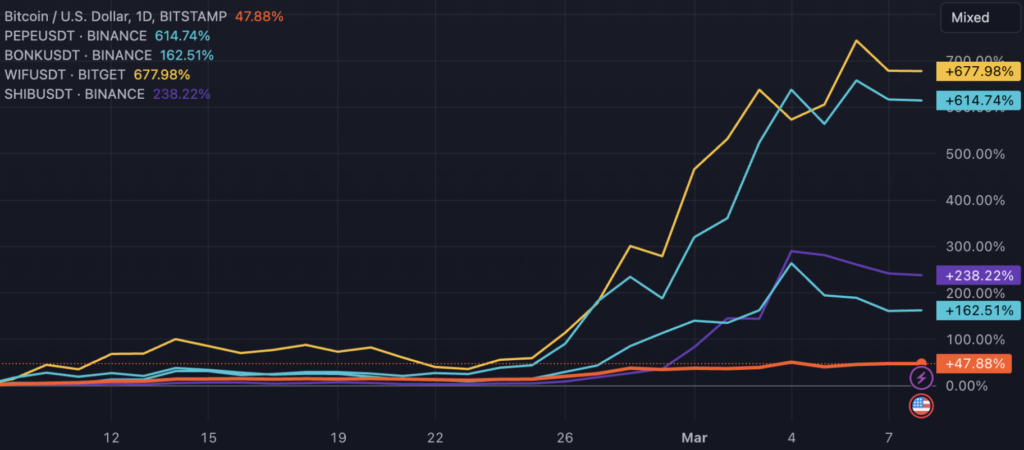

Strong performance in memecoins can sometimes precede local tops. When traders rotate from one narrative to another, they often end up rotating into memecoins—the prices of which are largely driven by hype. This has unfolded in recent weeks. Consider it one of the few checkboxes that can indicate the market is due for a breather.

Performance of PEPE (+614%), BONK (+163%), WIF (+678%), SHIB (+238%) and BTC (+48%) from Feb. 9 through Mar. 8 (Source: TradingView)

Performance of PEPE (+614%), BONK (+163%), WIF (+678%), SHIB (+238%) and BTC (+48%) from Feb. 9 through Mar. 8 (Source: TradingView)

Impending Alt Season

Historically, BTC has outperformed altcoins leading up to the previous cycle’s all-time highs. It may continue to beat many tokens weeks or months after reaching the milestone.

However, BTC will take a backseat at some stage because greed will result in investors rotating profits into altcoins to chase profits.

For this reason, it’s reasonable to start finding suitable projects to enter, especially while many of them continue to underperform BTC. Some may still be in an accumulation phase or have dropped materially from their local highs. This means it’s safer to start laddering into positions starting with projects you like that have favourable chart patterns. That’s at least how I like to approach it.

My Closing Thoughts

I’m not buying BTC right now. I’m also not selling my long-term holdings because they have tax implications. It doesn’t make sense for me to sell BTC and pay a higher tax rate than what I think prices will fall by.

All my core positions have been in place for quite some time, so any remaining funds will go towards trading, new launches, and other high-risk ventures.

If I’m starting now or still have funds to invest, I’d enter a portion into altcoins with favourable chart patterns, then ladder in over the next few weeks. Personally, I wouldn’t be chasing altcoins that have already pumped. I’ll find chart patterns that resemble those shown below.

Furthermore, consider checking in on your risk profile if you don’t own BTC. Irrespective of how bullish you may be on altcoins, BTC still remains the best risk-adjusted investment, in my opinion. (In bull markets, I see far too many people lose sight of the fact that investing is about the management of risk versus reward.)

Pullbacks may continue to be less intense, as we have already witnessed. If I think BTC will drop by 15–20%, I’ll place an order at around 10–15% in case institutions front-run the price, which can drag up the rest of the market.

Since dips may not be as big as in the past, I’d DCA more aggressively when you see significant drops, irrespective of whether I think it’d keep falling over the proceeding couple of weeks.

Finally, my biggest fear is not a 30% decline. I fear waiting too long and missing out on one of the best investment opportunities of my lifetime. The amount of money flowing into Bitcoin will put a floor on how low it can go.

Recap

BTC should be in everyone’s portfolio, in my opinion. (Of course, I acknowledge that everyone’s goals and circumstances are different. You know yourself better than I do.) I expect its price to continue climbing due to the halving and various other factors.